In Thailand, the PND 94 form is used to report certain types of income earned during the first half of the year (January to June). You need to file a PND 94 if you receive income under Sections 40(5) to 40(8) of the Thai Revenue Code, over THB30,000 as a single filer, and THB60,000 as a married joint filer.

These sections cover specific types of income that do not originate from regular employment, which is usually reported on other forms.

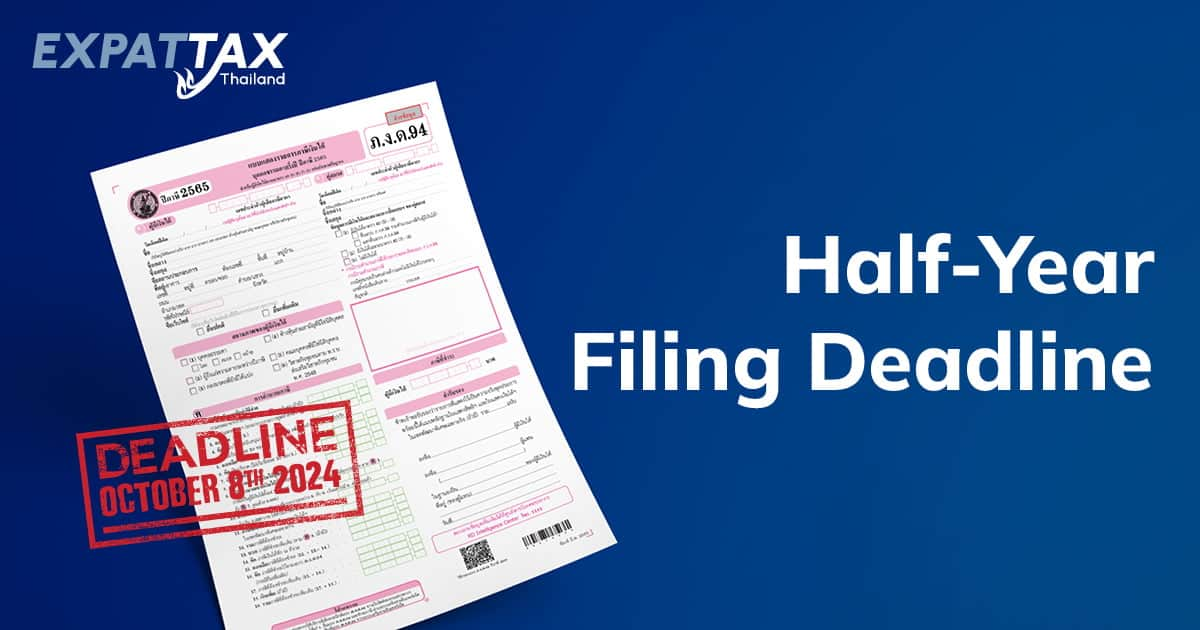

When is the PND 94 Filing Deadline?

The PND 94 form must be filed by the first week of October each year, covering income earned from January to June. If you miss this deadline, you could face penalties, so it’s important to file on time.

What Income Should Be Reported?

The PND 94 form is used to report income from the following categories:

- Section 40(5): Rental Income

Example: Income from renting out properties such as houses, condos, land, or vehicles. - Section 40(6): Income from Liberal Professions

Example: Income from professions requiring special expertise and often conducted independently, such as being a lawyer, doctor, accountant, or architect. - Section 40(7): Contractor Income

Example: Income from work contracts where the contractor must provide key materials in addition to their tools. - Section 40(8): Other Income

Example: Income from business, commerce, agriculture, industry, transport, or other activities not covered by the first seven categories. This includes selling goods online, running a photography shop, or operating a pet grooming business.

What is NOT Reported on the PND 94?

The following types of income are reported at the end of the year, not on the PND 94:

- Regular Employment Income (Section 40(1)): Typically reported on the PND 91 form.

- Pension Income (Section 40(1)): Also reported on the PND 91.

- Capital Gains (Section 40(4)): Usually reported on the PND 90 form.

Which Expats Need to File a PND 94?

Expats living in Thailand may need to file a PND 94 if they have income under Sections 40(5) to 40(8). Here are some common examples:

- Renting Out Property in Thailand

Example: An expat rents out a condo or house in Thailand to other expats or locals. This rental income must be reported under Section 40(5) and requires filing a PND 94. - Income from a Liberal Profession

Example: An expat works in Thailand as a freelance consultant, lawyer, or architect, providing independent services. This income falls under Section 40(6) and should be reported on the PND 94. - Working as an Individual Contractor

Example: An expat works as a contractor, such as a landscaper or interior designer. This income would need to be declared via a PND 94. Section 40(7) - Running a Business, Commerce, Agriculture, or Transport

Example: An expat operates an online shop, selling items on platforms like Lazada, or runs a pet grooming shop. This type of income is classified under Section 40(8) and should be reported on the PND 94 form.

Why Filing a PND 94 is Important

Filing a PND 94 ensures you are compliant with Thai tax laws regarding non-employment income. If you earn income under Sections 40(5) to 40(8), it’s crucial to report it correctly to avoid penalties and ensure you meet your tax obligations.

File Yourself?

If you would like to file your own return you can download the form from the Revenue Department’s website here.

Do You Need Further Assistance?

If you need to file a PND 94 half-year return, we offer this as part of our Assisted Tax Filing Service, which covers your half-year and end-of-year PND 90 return. The annual cost of Assisted Tax Filing is THB 12,000.

Please sign up below to get started.

Unsure about your filing requirements? Book a free call with our team, and we’ll help you figure out what you need to do.

How It Works

Simple Steps to Filing a PND 94

Our streamlined process makesfiling a PND 94 simple and stress-free.

Step 3: Enter Your Details

- Fill in your basic information and select the PND Half Year Returns (includes your 2024 end of tax year return).

Step 4: Set a Secure Password

- Create a password, check your email for a verification code, and enter it.

- Click ‘Let’s get started.’

Step 5: Click on ‘Review and Sign’

- You’re now registered and will see our online dashboard.

- Click on ‘Review and Sign: Essential Tax Filing Service Proposal.’

Step 6: Review and Approve Your Tax Filing Service Proposal

- The proposal outlines Expat Tax Thailand’s commitment to you, detailing our services and what we promise to deliver. Sign and tick the box.